Steward: Sales Approved, Name Changes, CEO Slammed

INSIDE THE ISSUE

> Steward Hospital Sales OK’d

> New Hospital Names

> Held in Contempt?

> Health Insurer Shenanigans

> Prior Auths & Stuck Patients

> Transition

MONDAY REPORT

Judge Says He’ll Approve Steward Sales; $17 Million Question Remains

United States Bankruptcy Judge Christopher Lopez last Wednesday said he would approve the sale of six Steward Health Care hospitals in Massachusetts, and he also signed off on a $42 million payment the Commonwealth of Massachusetts is making to Steward to cover operation costs at the hospitals through the end of September.

The sales approved were $175 million from Rhode Island-based Lifespan for Steward’s Morton Hospital in Taunton and Saint Anne’s Hospital in Fall River; $140 million from Boston Medical Center for St. Elizabeth’s Medical Center in Brighton and Good Samaritan Medical Center in Brockton; and $28 million from Lawrence General Hospital for Holy Family Hospitals in Haverhill and Methuen.

However, Lopez said he was holding back $17 million from the total purchase price of $343 million, and would declare by tomorrow, September 10, how much of that $17 million he would apportion to Steward’s creditors. As the three deals are now constructed, almost all of the buyers’ purchase price goes to the mortgage holders of the properties on which the hospitals sit. None of the money goes to the Steward’s “first-in-last-out” (FILO) creditors that have funded the money-losing Steward system over the years.

Michael Price, a lawyer for the FILO creditors, told the judge that asking the creditors to take zero dollars was unconscionable. “No one can be surprised that we are standing here today in opposition” to the sale, he said.

After calling a one-hour recess in the Texas bankruptcy court, Lopez returned to say that he was confident the law allowed him to approve the sale “free and clear” of the creditors’ interest and that he could withhold an amount and reapportion it as he saw fit. In response, a lawyer for the landlords/mortgage holders that are receiving the bulk of the $343 million said, “We’re not willing to accept another purchase price.” The attorney representing Massachusetts, Andrew Troop, from Pillsbury Winthrop Shaw Pittman, also expressed concern with the judge extracting $17 million from the hard-fought purchase price for the hospitals.

“I get it,” Lopez responded. “And I’ll get a ruling on it. Either you come to an agreement or I’ll rule on it, but these assets [the hospitals] will be sold.”

The deals must be finalized by September 30, and Lopez noted that whatever his court does, state and federal regulators must still okay the transactions. Speaking for Massachusetts, Attorney Troop said the commonwealth is committed to helping the hospitals “become the pillars of the community that they once were.”

Expect New Names for the Hospitals

Many of the religious names of Steward’s hospitals in Massachusetts (“Saint,” “Good Samaritan”) reflect the former Catholic hospital-chain owner of them – Caritas Christi. (Morton Hospital is named for former Massachusetts Governor Marcus Morton whose mansion became the hospital.)

When it sold its hospitals to Steward, the Archdiocese of Boston and the Vatican “conditioned their approval on the Hospitals continuing to operate as Catholic healthcare facilities in accordance with the moral, ethical and social teachings of the Roman Catholic Church,” according to a bankruptcy case filing from the Roman Catholic Archbishop of Boston. That agreement also states that if Steward ever sold the hospitals it would be required to return all religious artifacts and change the names.

Last Wednesday, lawyers for the archdiocese and Steward said they had reached an agreement on the issue, and Judge Lopez said his final order on the sale would mandate that the parties follow the agreement.

That most likely means that community members, long accustomed to referring to their hospitals as “Saint E’s” or “Good Sam” or “Holy Family” will have to learn new names once the new owners have settled in and begin transforming the facilities’ operations.

Steward CEO Won’t Testify and Is Slammed for Decision

LThis Thursday, Steward Health Care CEO Ralph de la Torre was expected to testify before the U.S. Senate’s Health, Education, Labor, and Pensions (HELP) Committee after the committee in July issued its first subpoena since 1981 compelling him to appear.

But last Wednesday, de la Torre’s lawyers informed HELP Chair Bernie Sanders (I-Vt.) that the Steward CEO would not appear because the bankruptcy proceedings were still underway and that all bankruptcy issues are being handled by a special subcommittee of Steward’s board of managers, and not by de la Torre himself. The attorney also cautioned against lawmakers turning the hearing “into a pseudo-criminal proceeding in which they use the time, not to gather facts, but to convict Dr. de la Torre in the eyes of public opinion.”

On Thursday, the vitriol aimed at de la Torre from local leaders was unceasing. “You should be held in contempt if you fail to appear. You should be fired from your position as CEO. You should lose your medical degree,” said Senator Ed Markey (D-Mass.), who sits on the HELP Committee. Senator Elizabeth Warren (D-Mass.) said, “Law enforcement authorities need to investigate Dr. de la Torre for possible criminal activities,” and Congresswoman Ayanna Pressley (D-Mass.) called his actions “shameful and devastating.” Governor Maura Healey said, “his refusal to testify before the Senate is shameful, but it follows his pattern of complete disregard for his responsibilities.” And Ellen MacInnis, R.N., a member of the Massachusetts Nurses Association Board of Directors, called de la Torre’s behavior “disgusting and loathsome,” and termed him a “greedy coward.”

“Healthcare workers kept showing up for work at Steward’s hospitals even when it was unclear whether or not they’d be paid what they were owed,” said Tim Foley, 1199SEIU executive vice president. “De la Torre owes his employees — and the public — the same basic respect.”

Business as Usual from Large Health Insurance Company

Last year, the large national insurer, UnitedHealthcare, joined some other insurers in cutting back on the number of procedures for which it would require “prior authorizations” — that is, the permission that healthcare providers need from health plans before delivering a medical service. In doing so, United drew cautious praise for reducing the administrative burden on providers and making it easier for patients to get care.

The positive move from the insurer was short lived.

Effective September 1, UnitedHealthcare’s Medicare Advantage program is adding procedures to its list requiring prior authorization. Specifically, physical therapy, occupational therapy, speech therapy, and chiropractic services delivered in office and outpatient hospital settings will require a prior auth.

“Following an initial evaluation, outpatient therapy and chiropractic services must be authorized for members new to therapy and those who are currently receiving therapy,” [emphasis added] United’s order reads. The insurer provided less than one month’s notice for the new policy.

A final rule from CMS this year places limits and guardrails on the use of prior authorization, including limiting its use to confirm the presence of diagnoses or other medical criteria or ensure that a service is medically necessary. CMS specifically states, “prior authorization should not function to delay or discourage care.” It requires prior authorizations to be valid for an entire course of approved treatment and to be valid through a 90-day transition period if an enrollee undergoing treatment switches to a new Medicare Advantage plan. (As noted, the UnitedHealthcare policy requires patients to get a prior auth even if they are already in treatment.)

“Providing less than a month’s notice and requiring patients already in therapy to get approvals is unfair to those patients and the providers caring for them, and results in unnecessary administrative burdens and delayed treatment,” said MHA’s Senor Director of Managed Care Karen Granoff. “Massachusetts law requires that carriers give providers at least 60 days notice when commercial plans make similar modifications. This is just another example of UnitedHealthcare ignoring the realities inherent in the provision of care.”

Why Are Excessive Prior Auths Harmful? Ask 1,768 Stuck Patients

Why are excessive prior authorizations bad? After all, they keep costs in line by ensuring that only “medical necessary” care is provided, right?

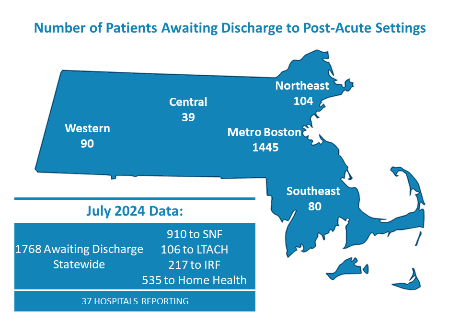

MHA’s monthly “throughput’ report that tracks how patients move from one care setting to another, shows what happens when a health insurance company fails to provide the prior authorization needed to facilitate the transition. In July 1,768 patients were stuck in acute care hospitals – no longer required to be there but unable to transition to a post-acute care facility.

Prior authorizations were not the only reason for the transfer delays, but “private insurance administrative barriers” were the leading reason, according to the monthly survey.

As Monday Report has previously highlighted, a hospital case manager wanting to move a patient often encounters a health insurance company that does not staff its offices on the weekends, delaying a transfer for 48 to 72 hours. Or they deal with an insurer that arbitrarily rejects the transfer even though the patient’s physician deems the post-acute care necessary. Peer-to-peer physician debates then follow, delaying care even longer.

A bed occupied by a patient dealing with a prior authorization delay cannot be used to care for a patient stuck in an emergency department waiting for a bed to open, further worsening backups and wait times. The cycle is continuous and harmful to all involved and often can be traced back to an insurer’s prior authorization process.

Transition

Dr. Laurie Glimcher, the president and CEO of Dana-Farber Cancer Institute since 2016 and a member of the MHA Board of Trustees, has announced her resignation from the post, effective October 1. Benjamin Levine Ebert, M.D., PhD, chair of Dana-Farber’s Department of Medical Oncology, will serve as the next president and CEO. Glimcher will stay at Dana-Farber, conducting cancer immunology research and mentoring physician-scientists. She will assume the title of President Emerita.

Ebert received a bachelor’s degree from Williams College and a doctorate from Oxford University as a Rhodes Scholar. He completed his medical degree at Harvard Medical School, a residency in internal medicine at Massachusetts General Hospital, and a fellowship in hematology/oncology at Dana-Farber.

Massachusetts Health & Hospital Association

Massachusetts Health & Hospital Association